The value of out-of-town assets is holding up surprisingly well despite the eCommerce boom. But there are shifting patterns. Less stock held on site means unit size requirements are getting smaller. Car parks that may have always looked oversized are now distinctly excessive. And, with the exception of the occasional dining or drive-thru unit, the space is dark at night with a large, empty car park.

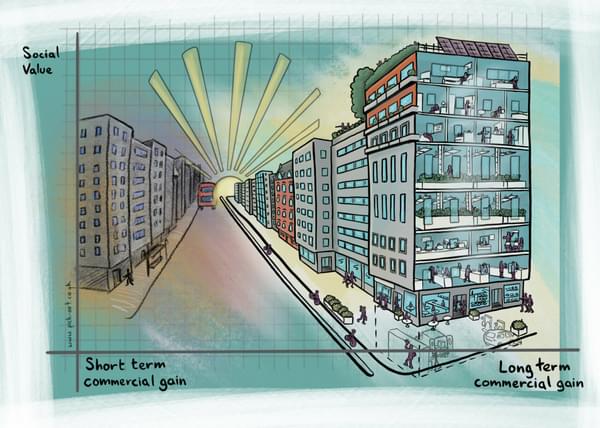

So, what's the long-term commercial, and indeed societal, opportunity from these assets? We believe the answer lies in the demand for power. As our demand for power increases, access to - and availability of - power becomes more valuable.

We're working closely with a number of out-of-town retail park investors to analyse how three macro trends interact to offer opportunity, and at their heart is the demand for power - for energy.

Let's put it very simply. Yes, the growth of eCommerce is having an obvious detrimental effect on traditional bricks and mortar retail. But, our societal need to tackle climate change, coupled with extraordinary technological advances has led to a rapid uptake in the use of electric vehicles (EVs) in all walks of life. However, this has escalated the need for power and placed a stress on our existing infrastructure, which requires some innovative thinking to find additional places to both store and provide power for EV charging.

Enter, the out-of-town retail park, ironically 'saved' by eCommerce.

The power of power

We've already established that many retail sites have excessive car parking provision. However, they also have oversized power supplies from a 'belt and braces' approach to design at park inception.

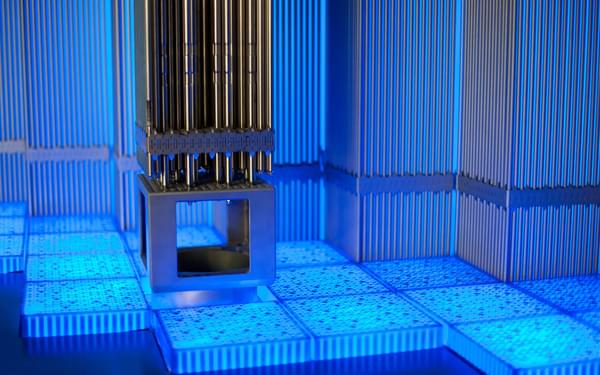

This spare capacity has value. Additionally, many parks could request additional power from the local network, or reinforce supply via onsite battery storage / renewables, bringing even more potential to the site.

By replacing oversupply of parking with grid-scale battery storage facilities, there is a real opportunity to achieve significant revenue generation.

And by providing electric vehicle charge points (EVCPs), further revenue is created during day-to-day park and charge. Indeed, it's a facility that could well increase footfall for those who only need to charge, and increase dwell time for those who planned to visit anyway.

But that's not all. When the sun sets, and consumers go home, instead of the park going dark, a whole new opportunity opens up to generate revenue and offer a valuable facility.

As we watch the eCommerce market boom, we see more and more electric delivery fleets. These, too, need charge options, and due to capacity constraints in industrial areas, this can’t always be at their headquarters or depot.

In a classic example of thinking creatively around the circular economy, if out-of-town retail park owners can connect with local fleet operators, they have the potential to create space for en-masse charging at night, while the park lies quiet.

It all comes down to thinking big, and thinking creatively to address our macro challenges in our energy transition.

The EV charging train - data's the ticket

To maximise what can be achieved from EV charging infrastructure, given the pressure on rolling it out at volume, we can become even more clever if we stop to analyse the data.

A lesser-known but critical factor in specifying EV charge points (EVCP), and consequential grid capacity requirements, comes down to user behaviour. This is an area that isn't well understood by most, and 'best guess' approaches are frequently leading to overspending, sometimes in the magnitude of £millions, and over-specification.

When undertaking capacity studies for EVCP most models make assumptions around a typical fuel station model, i.e. people turn up with an empty tank and leave with a full one. However, we know this isn’t always the case with EVs, particularly whilst 'range anxiety' is an influential behaviour.

During the day in our retail park scenario, a typical shopper may well turn up straight from home, after an overnight full charge, with a near-full battery. As Vehicle to Grid (V2G) chargepoints become more prevalent in future, through democratisation of energy, they may well choose to sell some of their accrued power if the rate is right. Other EV drivers may turn up with enough power to warrant parking in a non-charging space, but as they’re in an EV, they take the charging space and take some 'cheap energy' if it's available. Others may arrive with just minimal charge remaining, and are fuelled by a need to super-charge to maximum power in as little time as possible.

So, this simple example illustrates the diversity of use and behaviours. Without the data to inform and model these behaviours, investment in EV charging infrastructure remains a 'best guess' operation - until now.

At Hydrock, we have directly addressed this data gap by developing StratEV. This modelling tool provides a critical grain of detail regarding where EV charging users originate, their destinations, journey purpose, fleet composition and likely level of charge on arrival/departure. These details are fundamental to the optimisation of EV charging provision and avoidance of abortive costs.

It's all in the data, and through this level of forensic analysis we can help investors, developers, local authorities, fleet operators and charge point operators to consider the impacts of a range of situations to determine future parking capacity relative to needs, the opportunity for current and potential low-cost grid capacity, and the optimum number and type of charge points.

With change comes opportunity, and for out-of-town retail parks there's a real opportunity to repurpose their use for the next critical decade in our collective response to climate change and an energy transition.